The theme of this year’s World Water Day (March 22, 2014) is “Water and energy.” IFPRI senior researcher Claudia Ringler highlights the potential role of water markets in the water-energy-food nexus under global climate change

Drought and flood events increasingly make the news in every part of the globe. In 2012, China was in the news for severe summer flooding that caused $14 billion in economic losses. The following year, the country was affected by severe droughts that again had large negative economic impacts, while Central Europe grappled with crippling floods that caused economic losses of $22 billion. The 2012 drought in the United States affected about 80 percent of agricultural land and lowered average maize yields to levels last seen in 1995; food and energy price increases as a result of this drought are still impacting the US economy. The ongoing California drought similarly affects all economic sectors and local livelihoods, and has caused energy costs and food prices to rise in much of North America and further afield.

While the impacts of these extreme events on food production are well understood by the public, their impacts on energy production are less recognized, even though energy generation uses a tremendous amount of global freshwater resources. Droughts—particularly prolonged ones covering vast areas— are especially damaging to hydropower production, which accounts for about one-fifth of all energy generation, but they affect other energy sources, too: lowering or even halting thermal energy production, disrupting coal production, and also lowering biofuel production.

While we often hear about the impact of extreme events on many large-scale economies, their impact on poorer economies is greater still, since poor populations in developing countries are highly vulnerable to shocks and environmental stresses. The livelihoods and incomes of the rural poor are highly dependent on their ability to produce food in the short term; extreme weather events such as droughts and floods place immediate and often crippling stresses on their productive capacities. The urban poor, meanwhile, spend a higher percentage of their household incomes on purchasing food, and both high food prices and high food price volatility brought on by weather-related shocks severely limit their ability to meet their basic food and nutrition needs.

Given the significant relationship between extreme events and water, water-based and water-related coping and adaptation mechanisms are critical. The two most common strategies for coping with these extreme events are 1) developing water storage and 2) improving the efficiency or productivity of water use.

The establishment of water markets is not usually proposed as a mechanism to address climate extremes, but it is a strategy worth pursuing. In a chapter on “Water Markets as an Adaptive Response to Climate Change” in the forthcoming book Water Markets for the 21st Century: What We Have Learned, my IFPRI colleagues Mark W. Rosegrant, Tingju Zhu, and I suggest that it could be a mistake to not consider the option of water markets in areas with increasing water variability.

Establishing a water market requires well-defined property rights for water. These rights have economic value that reflects the underlying asset (use of water). As in any market, these rights—or their use—are then traded: bought, sold, or rented for a given amount of time. The physical conveyance structure must also be available, and relevant transaction costs must be low enough to encourage trading. Private property rights empower individuals to pursue profit through either accumulating more rights or selling them. They can also empower private groups to pursue either profit or non-monetary objectives such as environmental goals, such as streamflow restoration.

Water markets and tradable water rights empower water users by requiring their consent to any allocation of water and by compensating them for any water transferred. This provides the starting point from which a market can begin to efficiently allocate resources to its highest-valued use. Agricultural water users can particularly benefit, as non-irrigation demands on water and climate change increase the pressure to move water away from irrigation.

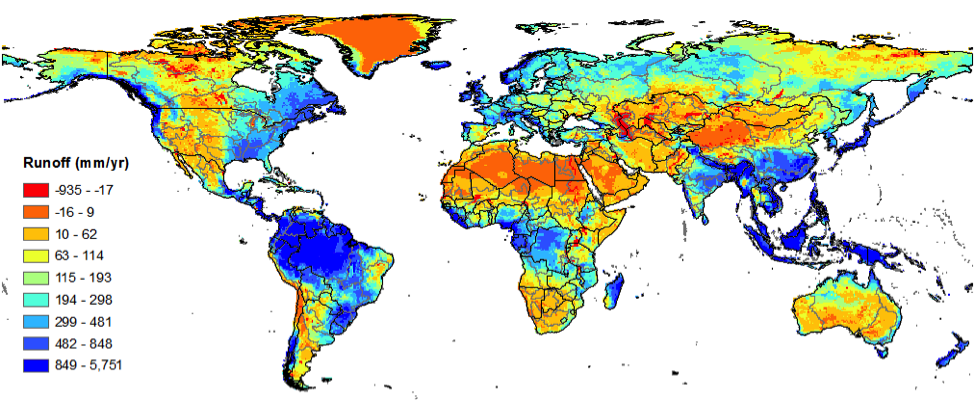

An increase in water variability due to droughts and floods might well propel the development of new water markets that would address—by design—the variability in supply and add flexibility to otherwise rigid water-delivery structures. As the map shows, water markets would make most sense in regions where water has been or is increasingly scarce and where inter- and intra-annual variability is large or growing, such as the Western United States, parts of South America, both North and Southern Africa, West and Central Asia and Pakistan, Northern China, and large parts of Australia. In addition, water markets can address not only climate variability but also long-term climate change, as higher temperatures will reduce water supplies even further.

Despite the apparent potential of water markets, they currently play a minor role in most water-scarce regions. Climate change and growing variability in water supplies, however, will likely require policymakers to take a second look at this coping mechanism, as the value of water increases and the need for flexibility in allocating it continues to grow.

“Water Markets as an Adaptive Response to Climate Change,” a chapter by Mark W. Rosegrant, Claudia Ringler, and Tingju Zhu in Water Markets for the 21st Century: What We Have Learned, edited by K. William Easter and Qiuqiong Huang, is scheduled for publication in late 2014 by Springer.