El Salvador, Guatemala and Honduras are among the poorest countries in Latin America and the Caribbean (LAC), with worse undernourishment than the average for the region. Developments in the world economy affect these countries through a variety of channels, including trade, financial flows, remittances, and migration. This post looks at the potential impacts of changes in U.S. migration policies on these three Central American countries using economy-wide models. The analysis shows that large-scale deportations would have various negative economic effects, compounding poverty in those countries (strengthening incentives to emigrate). It also argues that the U.S. economy would suffer from resulting declines in exports to those countries (although, given differences in sizes, the scale of the negative impact is limited).

Currently, about 4.3 million people from these countries live in the United States (either as direct migrants or as descendants of migrants); this represents almost 14 percent of the combined population of the countries of origin. About 1.8 million of them are undocumented and at risk of deportation under new U.S. immigration policies: More than 800,000 Salvadorans, about 600,000 Guatemalans, and almost 400,000 Hondurans.

These potential deportees represent about 4 percent of the population in Guatemala and Honduras and more than 13 percent in El Salvador. Deportations will have important impacts on the economy and society of those countries through several channels.

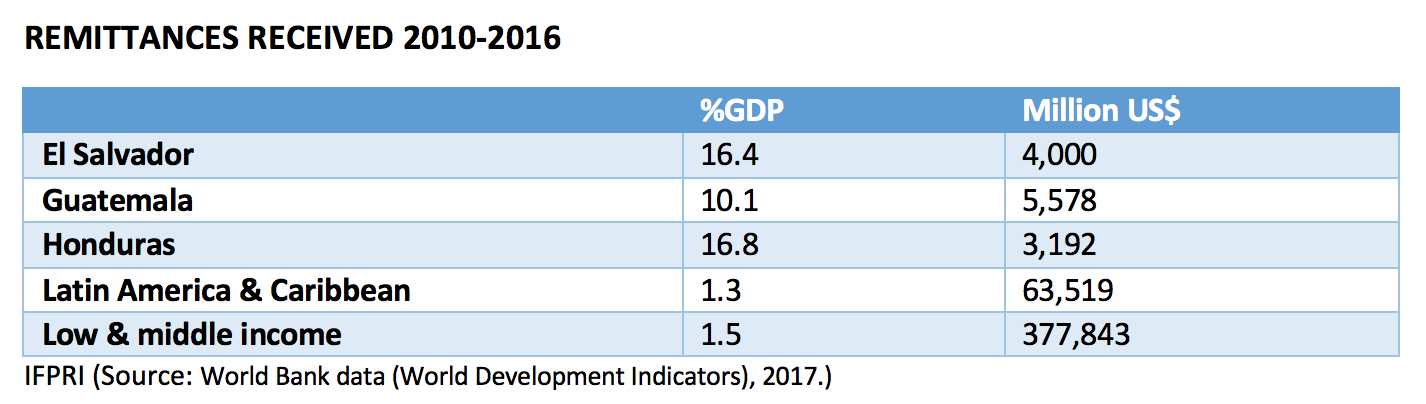

A reduction in the value of remittances. These countries receive between 10 and 17 percent of their GDP in remittances (far above the norm for LAC and developing countries as a whole), for a combined total of over $12 billion per year on average during the 2010s.

An important expansion of the labor supply in the receiving countries. The implications of such an expansion will depend on how many find employment and the resulting impacts on production, depending on the age structure of the deportees and their levels of qualifications and experience; and how many will remain unemployed after they return.1 In turn, an increase in unemployment may impact the overall business climate and private sector capital accumulation. The more negative scenario would be one in which unemployment leads to increased crime, a general deterioration of the business climate, and declines in private sector investment. On the other hand, returning deportees may bring new qualifications, business networks, and savings from the U.S., spurring investments and growth.

Effects on fiscal accounts. For instance, countries may want to provide some basic safety nets to deportees to avoid social unrest. Alternatively, they may have to increase expenditures to control crime. On the other hand, those returning and finding productive jobs would expand GDP and fiscal revenues. Therefore, effects on fiscal accounts could be both positive and negative, with implications for taxes and overall public expenditures, including public investments.

Using a Computable General Equilibrium (CGE) modelling framework in a comparative static exercise, we consider two scenarios for the levels of deportation and the impact on remittances. The first considers the deportation of all undocumented migrants and the related notional decline in remittances (Scenario 1). Deportation of all undocumented migrants may be infeasible for logistical and political reasons, but serves to establish a benchmark. In the second scenario, only half of the potential deportees are sent back to their home countries with loss of their remittances (Scenario 2). This scenario helps determine whether there are scale or non-linear effects in the shocks simulated.

In the first scenario, the decline in remittances forces a strong adjustment in the three LAC countries, with drops in all components of domestic absorption (consumption, investment, and government expenditures) and a sharp decline in the trade deficit. In the case of Guatemala and Honduras, the trade adjustment is generated both by a more competitive real exchange rate2 (expenditure switching) and by the decline in domestic absorption (expenditure reduction).

In El Salvador, the adjustment can only come from the decline of domestic prices for goods and services (deflation). In addition, all factors of production see drops in returns to accommodate the shock: Nominal wages decline by 6.4 percent, return to capital by 3.5 percent, and return to land by 8.5 percent. These results illustrate the fact that if a country dollarizes (El Salvador adopted the U.S. dollar as its currency in 2011), it must have an important level of flexibility in nominal variables to confront external shocks. If that flexibility does not exist, then unemployment of labor, capital, and land will all increase.

In the second scenario of a smaller shock, effects are broadly proportional to the different assumed levels of deportees, with all macroeconomic variables showing impacts about half of those in the first scenario (i.e. we do not find scale or non-linear effects).

In scenario 1, the decline of GDP per capita is substantial, ranging from 14.7 percent in El Salvador to between about 4-6 percent in Honduras and Guatemala. As before, the results for scenario 2 are scaled down by about half.

Another impact of the decline in remittances as a result of large deportations is a reduction in the trade deficit: Between about 7 and 10 percentage points as a proportion of GDP in scenario 1 and between about 3.5 and 5 percentage points in scenario 2. These declines stem from a significant expansion of exports and from a compression of imports to compensate for the lack of remittances that previously financed the trade deficit.

Exports increase as a proportion of GDP by between about 3.6 percentage points (El Salvador) and more than 9 percentage points (Honduras; Guatemala falls in between), while imports decline by between 1-2 percentage points (Guatemala and Honduras) and about 4.5 percentage points (El Salvador). In both scenarios, the trade deficit will persist at lower levels because people living legally in the U.S., as well as in other countries, will still send remittances.

These trade adjustments will affect countries’ bilateral trade position with their trading partners. The United States maintains trade surpluses with all three countries, for a total of about $2.6-2.7 billion in 2015-2016. But the adjustment in the trade balance needed to accommodate the shock of the deportation and drop in remittances would certainly reduce U.S. trade surpluses with those countries. This will have a negative impact on U.S. employment in the export sector, which tends to pay higher salaries than average. Therefore, from the point of view of the U.S., the postulated improvement in employment generated by the deportation of people from Central America (who usually occupy lower-paid jobs) must be compared with the potential decline in higher-paid export jobs.

In summary, the simulations suggest strongly negative impacts on the economies affected. If deportees do not find jobs immediately, the declines in GDP per capita may range from almost 15 percent in El Salvador to between 4-6 percent in Guatemala and Honduras. If nominal variables have less flexibility to respond to the shock, unemployment levels in all factors of production will increase, driving real GDP even further downward.

If deportees remain unemployed, they face the risk of dropping below extreme poverty levels. Preventing this by using for instance a cash transfer per capita to all deportees that remain unemployed, as a minimal safety net equivalent to the income level of extreme poverty ($1.90/day in 2011 PPP dollars) would increase fiscal deficits from 0.4 to 1.4 percent of GDP in all three countries.

The trade compression caused by deportations suggests that the U.S. may experience losses of higher-paying export jobs. Based on the aims of the current U.S. administration, these potential losses must be compared with potential gains in jobs with lower skill levels.

At the same time, as real wages in domestic currency fall in the three Central American countries and as nominal domestic currencies are devalued (in Honduras and Guatemala) or stay the same (in El Salvador, because of dollarization), domestic salaries measured in dollars decline further. This may increase incentives to migrate, which could also add to U.S. border control costs.

Eugenio Diaz-Bonilla is Head of IFPRI’s Latin American and Caribbean Program; Valeria Piñeiro is a Senior Research Coordinator in IFPRI’s Markets, Trade and Institutions Division (MTID); Sherman Robinson is an IFPRI Research Fellow Emeritus. The authors wish to thank MTID Communications Specialist Sara Gustafson for her valuable contributions. This post first appeared on the International Centre for Trade and Sustainable Development (ICTSD) blog.

1. Using current data, if all the undocumented are deported, and they do not find jobs, then unemployment could jump to about 34 percent in El Salvador, 11 percent in Guatemala, and 17 percent in Honduras.

2. Because the real exchange rate (RER) is defined as the price of tradables divided by the price of non-tradables, an internationally more competitive rate implies an increase in the ratio. However, this is sometimes referred as a “devaluation” of the RER, because the local currency typically losses value (i.e. “devalues”) against the foreign currency or currencies of reference. If the RER becomes less competitive, then the ratio decreases and the local currency is said to have been “revalued.”