A key Congressional proposal for corporate tax reform would catapult the United States from being the country with the 104th highest tax rate on consumers to the undisputed world leader, resulting in an average 33 percent sales tax nationally. In an IFPRI discussion paper, I examine the potential impacts of this plan and find that the conventional wisdom is wildly misleading on many aspects of the proposal.

A border adjustment or destination-based tax is a central element of the proposed tax reform plan. Under the proposal, both imported and domestic products sold in the U.S. would be taxed, while exports would be exempted.

The proposed 20 percent tax is equivalent to a value-added tax (VAT) of 25 percent. State sales taxes averaging 6.4 percent nationwide would be applied on top. The resulting average consumption tax rate of 33 percent would far exceed the 27 percent VAT of the current world leader, Hungary.

Will Martin/IFPRI

If you’ve been following the debate on corporate tax reform, you’ve probably heard a number of arguments:

- It taxes imports and so helps domestic producers

- It subsidizes exports by not taxing them and allowing exporters deductions for input costs

- It would cause an exchange rate appreciation so it won’t really hurt consumers

- Deductibility of investment expenditures would stimulate investment

- It involves a reduction in the corporate tax rate from 35 to 20 percent

- It would raise lots of revenue for spending initiatives.

My analysis suggests that virtually all of these propositions are either flawed or incorrect.

In reality, this proposal would not introduce trade barriers. The core of the proposal—to tax goods sold domestically but not those exported, and to provide a tax deduction for business inputs—mimics the value-added taxes (VATs) used in almost all other countries and accepted as non-trade-distorting by virtually all economists. How can measures like these—that tax imports as they enter—not discriminate against imports? Because like the familiar state sales taxes, they tax imports and domestic goods equally in the home market.

Nor would the proposal subsidize exports, because the tax deductions exporters would receive merely offset the increased prices that exporters would have to pay for their inputs.

Making investment expenditures immediately deductible, meanwhile, would not stimulate investment. Rather, it would offset the increase in domestic prices of investment goods resulting from the border tax adjustment. The abolition of the traditional corporate tax might, however, stimulate investment to some degree.

The border-adjusted tax is a consumer tax, and not ultimately borne by firms, so the 20 percent rate is not at all comparable with the current corporate tax rate of 35 percent. If applied without the deduction for labor costs, it would generate tax revenues equal to 17 percent of GDP—vastly more than the roughly 2 percent generated by the current US corporate tax.

In addition to the taxes on goods—and in contrast with any other country’s policy—the proposal includes a deduction for labor costs that subsidizes employment of labor. However, this does not subsidize exports, because wages would be bid up in tandem with rising prices, offsetting any initial benefit to employers.

Because this combination of measures neither taxes imports nor subsidizes exports, there is no reason to believe it would drive up the real exchange rate. This means that consumers would suffer the full burden of the resulting increase in consumer prices.

So, surely, then, the proposed measure would raise a lot of revenue? Actually, the revenue yield would be small, volatile, and vulnerable to disappearing altogether. The fundamental problem is that the revenue obtained would be the difference between two large and volatile magnitudes—the revenue from taxing consumption and the spending on wage subsidies.

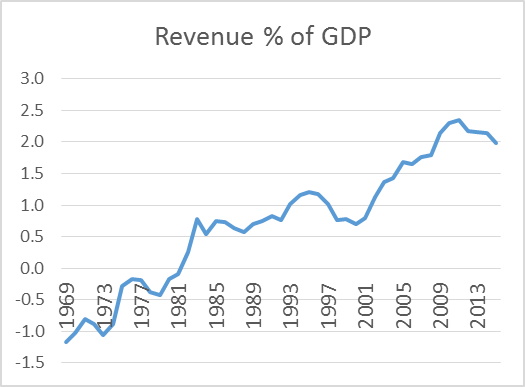

At current GDP shares, the proposal would net around 2 percent of GDP in revenues, but with great year-to-year volatility. Since 2000, its revenue contribution would have fluctuated between 0.7 and 2.4 percent of GDP. As shown in the graph at upper right, its yield would have been negative about a quarter of the time over the past 45 years. Without the wage cost deduction, revenues of 2 percent of GDP could be obtained from a destination-based corporate tax at less than 3 percent, rather than 20 percent as proposed.

The innovation of including a wage cost deduction is what would drive the resulting sky-high tax on consumers. This wage subsidy would have the desirable feature of raising nominal wages, but only in line with now-much-higher consumer prices. People entering the labor force as the measure was introduced and thereafter would be OK—they would have higher wages throughout their careers to offset the higher cost of living. But everyone older would suffer because they had spent part of their working lives in the low-wage era—with a consequent lower ability to save for retirement. This change would also create a magnet for temporary immigrants—people attracted by the higher wage, but not planning to spend all of their income in the United States. Hardest-hit, meanwhile, would be the elderly and the poor living on fixed incomes. They would see their real incomes slashed by an average of 27 percent.

Will Martin is a Senior Research Fellow in IFPRI’s Markets, Trade and Institutions Division.